You may have wondered one day how many Forex sessions are there. In fact, there are 4 forex sessions in the market, and each Forex session has its effect on certain currencies. Many strategies depend on trading using sessions, either at their opening or closing times or even combining sessions to benefit from the great momentum that occurs at that time.

Find out the Power of Forex Sessions

1 – How many Forex sessions are in the market?

There are four Forex sessions: London, New York, Tokyo, and Sydney. Each of these four sessions has its opening and closing times. For example:

(The times that will be mentioned will be according to Moscow time GMT+3 and we will mention some tools & websites that will help you determine the session times according to your country)

London

The opening hours of the London Stock Exchange start at 10 AM and end at 7 PM, The London Stock Exchange is one of the strongest stock exchanges in Forex, as there is very high momentum when the London Stock Exchange opens, and prices move at a faster pace than usual when it opens.

New York

The opening hours of the New York Stock Exchange start from 3 AM until 12 (Midnight), and when the London Stock Exchange opens, its opening is an overlap between the two strongest stock exchanges in Forex, which are London and New York, and you will notice that on the chart as prices move by larger points than London or any other Forex sessions, as these two sessions are among the best sessions preferred by traders, that is, from 3:00 PM until 7:00 PM, you will see a very good movement in prices at this time.

Tokyo

The Tokyo Stock Exchange opens at 3:00 AM until 12:00 PM and the momentum is very slight during this time, but only on certain pairs. However, the movement in the Japanese Yen pairs (JPY) is almost normal, and you may see high momentum when the Tokyo Stock Exchange opens.

<<< Reasons Why Traders Fail when Trading Forex >>>

Sydney

The Sydney Stock Exchange Opens from 12 Midnight until 9 AM and we can say that the same thing happens in the London and New York Stock Exchange overlap, as the JPY & NZD & AUD currencies are affected by the overlap of the two stock exchanges and the pairs move a little but not a lot because the real momentum occurs during London and New York.

You may have noticed that the four Forex sessions have one thing in common, which is that they all work throughout the day for only 9 hours, but in fact, all stock exchanges work in their usual morning time between 8:00 AM like London and 9:00 AM like Tokyo and 9:30 AM like New York and 10:00 AM like Sydney,

So they all work in the morning according to their local time, but the time difference between countries is what makes the difference between the opening and closing different from each other, and also the four stock exchanges work together to provide continuous liquidity in the market, Therefore, you find that the market is constantly moving with varying momentum, which may increase or decrease at times when there is not high liquidity in the market for some pairs, of course.

Please note that the opening and closing times may increase or decrease by one hour depending on daylight saving time and your country as well. Therefore, When you find out that the times have changed in your country, you should know that the opening and closing times of the stock exchanges will also be adjusted in this manner.

How to know Forex Session times?

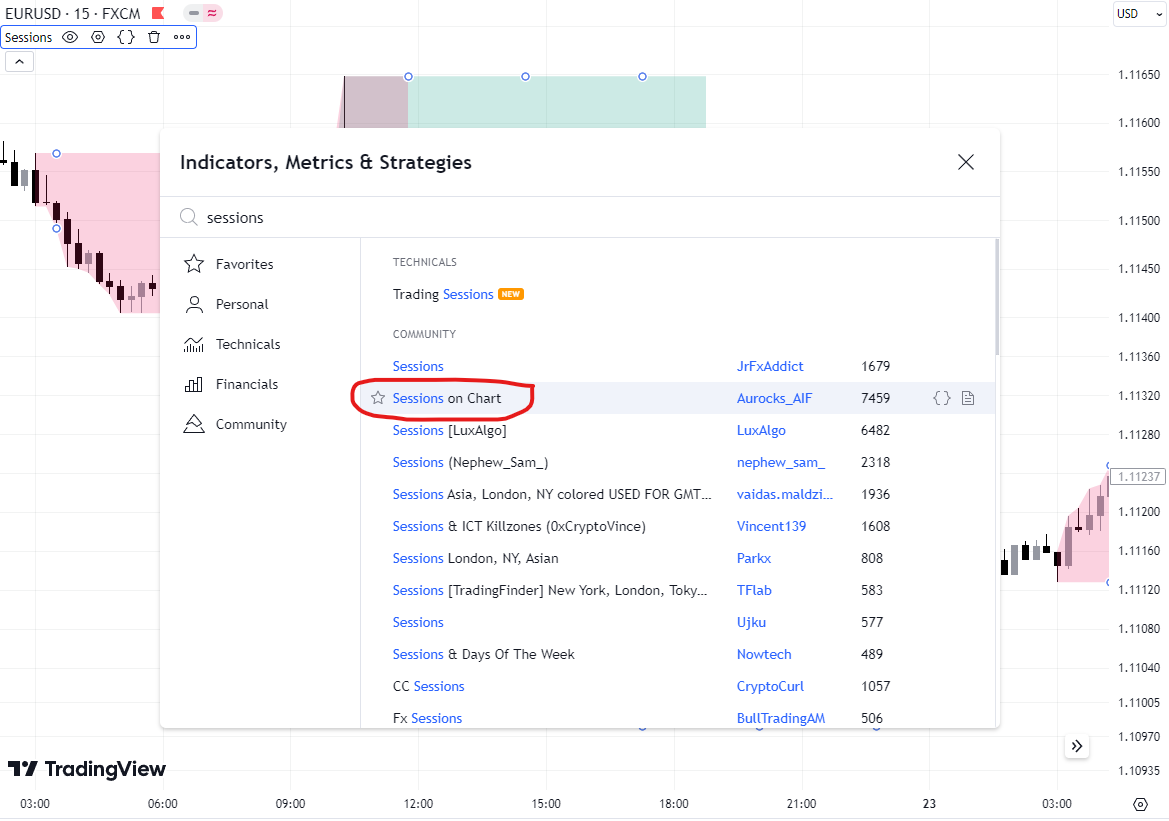

The times indicated above are Moscow time, but even if you are from Moscow, it is important to use some tools to know the opening and closing times of global stock exchanges. There are indicators in Tradingview that help you identify the opening and closing times of stock exchanges. Just type sessions in the search for indicators and choose what suits you. If you want an opinion, I use this indicator.

You can adjust its settings according to your country’s time and you can show or hide the sessions. I advise you to hide the Sydney session because it is not as important as the other sessions. Of course, you are free to choose.

There are also websites that may help you to know the Forex session times and which sessions are currently running. This will make things easier for you more and more, as it is not necessary to set the time for your country in this case, Among these sites are:

Forex factory (You will find the Forex session times at the Bottom of the page)

2 – How Trading Forex Sessions Impact Market Activity

How can forex sessions affect the market? As we all know, the market moves based on supply and demand, right? But if there is no one to place buy and sell orders for you, will the market move in this case?

Most likely the answer is no because the global stock exchanges are the ones that provide liquidity in the market and activate your buy and sell orders. If the 4 global stock exchanges are closed, you will not find liquidity in the market. Therefore, if you notice the Bank’s holiday time at the end of the year, for example (I do not mean Sunday and Monday), you will find that most of the Banks are on holiday and you will find that the movement of the pairs are very slow because there is not enough liquidity for these currencies to move.

But this does not mean that the Forex market has become dead at this time and you will find other currencies moving very significantly because these currencies are currently available at this time and have high liquidity as traders turn to these currencies to work on them instead of the currencies that are inactive in movement.

3 – Forex Sessions Overlaps and Their Power

You may have noticed that the overlap of forex sessions is a very good thing as you can take advantage of this large liquidity to achieve great profits, right? This is what traders usually do as they take advantage of the overlap of the London and New York sessions to open their deals or take advantage of this liquidity to identify the next movement of the pair and there are many strategies that help in that of course

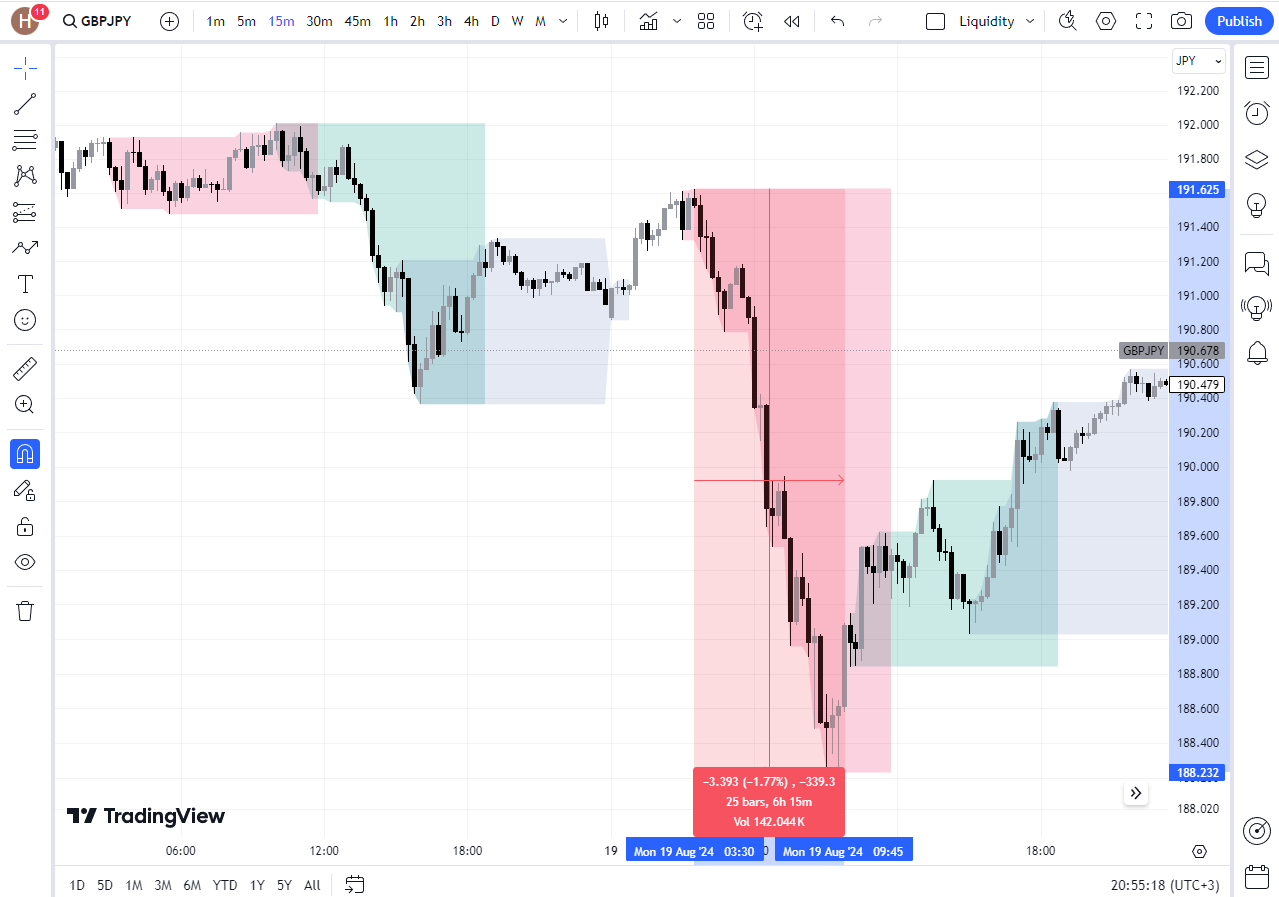

In this example, I used an indicator in Tradingview to determine the forex session times and you will find that the London session is in green and the New York session is in light blue. Of course, there was good momentum in the London session, but when the New York session started and the two sessions overlapped with each other, you will notice the great momentum that entered the market and the noticeable price movement at this time.

There is also an overlap between the Sydney session and the Tokyo session, as momentum begins to move the market with the start of the Tokyo session because Sydney starts three hours before Tokyo. When the Tokyo session overlaps with Sydney, you will notice momentum entering the market, but not in all currencies. As we mentioned earlier, At this time the market is a bit inactive. and the London and New York Stock Exchanges are closed, but the momentum is in the pairs related to the JPY, such as GBPJPY, for example.

Also, it is not necessary to see a lot of momentum at this time. It is normal for the movement to be very slow, but the Asian market will likely move with high momentum.

4 – How to Trade Using Forex Sessions Overlap

There are strategies that traders use to take advantage of high-momentum movements during session overlaps.

London & Newyork

The London and New York sessions are the best forex sessions in which you can achieve good profits and you can trade at these times, but if you see any opportunity before this overlap, for example during the London session, you can enter the trade you want, there is no mistake in that, and when the overlap occurs between London and New York, the price momentum will increase and reach your target (or stop loss)😀

One of the strategies that you can use during the London and New York session overlap is that most often when the New York session opens, if the price wants to rise, it falls first in order to make traders believe that this session will be bearish, but the exact opposite happens and the price rises and collects all this liquidity (Stop loss for Sellers) and continues its rise.

Of course, this doesn’t need to happen. It is natural for it to fall and continue its fall or continue the London movement…etc, This method will not help you enter into any trade, but you must integrate it with your trading strategy. For example, if there is a strong support area below London and when the price falls to it in the New York session, this may indicate the strength of this area and this scenario will likely occur.

Why would this scenario happen? Mostly at the opening of London or New York, the first top or bottom that is formed is liquidity, i.e. a trap by the market maker. This trap attracts traders to make them believe that this session will go in a certain direction, and then the exact opposite happens. This is logical for the trader, as he waits for the opening of the forex sessions to start trading, and the market maker knows this very well, so he sets these traps to catch them.

The pairs that you will be working on are the major USD pairs such as EUR/USD. GBP/USD, USD/JPY and USD/CHF, If you want to trade on any other pair, you can of course do so, but test the strategy on it first to make sure that it works on this pair.

Tokyo and Sydney

The matter is somewhat different with the overlap of the Tokyo and Sydney sessions because the pairs are different and the momentum is also different. For example, you will find that the movement of the GBP/JPY at the beginning of the Tokyo session is very large, as it moves more than 100 pip before the opening of London, and this is not a small number.

One of the strategies that you can follow during the Tokyo-Sydney overlap is that if you find that the pair’s movement has exceeded 100 or 200 points, it is likely that the price will return to fill this gap that it left at the beginning of the London session.

SMC analysts believe that this Gap is a Liquidity Void, It is natural for the price to return to it again to fill this gap again, and of course, this doesn’t need to happen. If you look at the chart for any gap, you will notice that there are many gaps that the price has not returned to, because it is targeting other gaps on different time frames.

It will also help you understand this part if you know the average of pips of the pair in the day or week. For example, the GBPJPY pair moves throughout the day from 100 to 300 points. If the Tokyo session starts and GBPJPY moves 300 points until the London session, that means it has exhausted most/All of its points before the start of the trading day, right? What does this indicate?

There are two possibilities and a third possibility may happen, but most likely it will not happen.

The first possibility is that the price will return to fill this gap that it has created in a very short period, so it must move for the rest of the day, right? So where will it go? Up to fill this gap Correct, and what may increase this possibility is that if it bounces from a strong demand area, it will rise strongly.

The second possibility is that it has already exhausted all the pips it is accustomed to during the day in a short period of time and will make a sideways movement for the rest of the day and no change will occur until the second day.

The third possibility, of course, will continue the downward movement that has exhausted all its pips. If that happens, it is likely that there is strong news that has pushed it to complete this decline, because the news is like the gas that helps the price to move even after it reaches this limit.

In order not to be distracted, try to focus on one or two sessions, or you can focus on the overlap between the London and New York sessions only. If you do not trade Asian currencies, do not pay much attention to the Tokyo and Sydney sessions, because in this case, they are not useful to you.

5 – Impact of Major Economic Releases on Forex Sessions

Usually, important news is issued during the London and New York sessions, as these are the most interactive times of any forex session, but news related to the JPY, AUD, and NZD is issued during the Tokyo session, and you will also notice that the news of inflation for the GBP currency is issued at 9 am, so you must follow the news continuously and not rely only on the London and New York sessions.

What makes the New York and London sessions important to traders is that important news is released at such times. such as Interest rate, NFP, Unemployment change, Home sales, and CPI.

News is a good way to move prices, but it is not necessary for prices to move only at the time of news. Prices move strongly whether there is news or not, as this will not be an obstacle for you in trading, but in the case of news, the movement becomes much stronger than usual.

Can trade forex Sessions during News?

Of course, you can trade whenever you want but the problem here is if there is strong news about to happen like inflation rates then trading strategies at such times do not help you much in making the right decision, but what helps you is economic analysis and integrating it with your strategy in this case you will be able to understand what is happening in the market and you will decide whether entering at the time of the news is good or not

As for Low-impact news that does not affect the market much, such as Trade Balance and Natural Gas Storage, this news you can ignore them and trade as usual because the price does not react to it and the market does not care much about its movement.

What is the difference between knowing the session times and not?

If you know the opening times of the forex sessions, you will know when there is momentum in the market, and therefore you will know what you should do at such a time. There are strategies, as we explained previously, that help you trade at such times. There are also times when the Banks are on holiday And if you don’t know that time. In this case, you will notice that there is no noticeable movement during the forex sessions.

This is unusual, right? In this case, you will make the right decision for you, which is most likely not to trade this currency, because, during the holidays, the movement of the pairs is often unclear and difficult to analyze.

If you do not care about the forex session times, any time will be suitable for you (maybe not) Knowing the session times helps you trade at the right time so that you do not sit in front of the chart and wait for the momentum to join the market, but there is an easier way to let you know when the momentum will join the market by knowing the forex Session time.

There are also traders who use session times in their strategies. If you follow the forex session times, you can create your own trading strategy. All you have to do is monitor the price well for a long period and watch its reaction when opening and closing the sessions. If you find a pattern that it does every time at the opening and closing time, you can exploit that to create a trading strategy from which you can profit.

6 – What is likely to happen when forex sessions open and close?

The price reacts at the opening and closing times of the forex sessions. For example, at the opening time of the London session, you may notice that the price immediately begins to move quickly at the opening, and you will most likely notice that this opening time is the highest or lowest point of the day, London is usually the session that creates the Low or High of the day.

If London closed in this case, the market would be drained of liquidity and the movement would become very slow, although New York is still open, but it will not be enough for the price to move as usual.

Almost the same thing applies to New York. When the session opens, the price starts moving quickly and may continue the movement of London or break the top or bottom formed by London.

7 – Conclusion

Forex sessions are very important for any trader and knowing the opening and closing times of these sessions helps you a lot in understanding the market as you can achieve many profits in trading during the forex sessions because you will choose the right time and you will choose the right levels from which you will enter your trade, One of the most important times of market momentum is the overlap of the New York and London sessions, which lasts for four consecutive hours.