To start opening a forex account, you must be aware of the forex market and the basics of trading because you will not benefit from opening a forex account without experience and learning, at least understanding the basics of forex to know what you are about to do.

Steps to open a Forex account

1 – Choose the right broker

The broker you will choose is the one you will work with and assist you with any problem you face, so be very careful when choosing the broker based on essential criteria. Some meet these criteria while others do not so choose the company that suits you wisely.

There are two types of brokers in the forex: STP and Market Makers, and these criteria may apply between these two types of companies. The difference is that STP executes orders from the customer to the bank directly without interference from the company and this type of company is highly recommended.

As for the market maker, the broker may manipulate prices and the orders you place, the market maker is also a liquidity provider for the market. This type of broker is not interested in you to making money but rather wants you to lose your money. In addition, it also profits from the spread, but it can manipulate prices at any time.

1 – Licenses

Broker licenses are one of the most important and biggest sources of trust for the client because the license is the one that guarantees the rights of clients if the company cheated a client, so the client returns to the license and submits a complaint in the company, and the license is obligated to return the client’s right and hold the company accountable if it is an Infraction.

And one of the strongest licenses recognized (ASIC – FCA – CySEC), It is not necessary for the brokerage company to include these licenses. The broker may obtain different licenses due to the company’s headquarters being located in this country, for example.

2 – The duration of the broker in the market

Is this broker new to the market or has enough experience to deal with problems and has many clients who trust him? The duration of the broker, the greater it is, this indicates the credibility and strength of the broker, and the minimum period is 5 years to trust this broker (and this is not a requirement, the broker may have a duration in the market of fewer than 5 years, but it is reliable, so it is difficult to judge a company by its age in the market)

The length of time a broker has been in the market is an important factor in determining whether a broker is reliable or not and you will notice this from the customers reviewing of whether it is good or not.

3 – Deposits and withdrawals

Are the banks that the broker offers for deposits and withdrawals suitable for you? If the answer is no, then of course I do not advise you to sign up with this broker because you will not be able to make any withdrawals or deposits

But if the answer is yes, then you have to ask yourself how long does the deposit or withdrawal take, and what is the commission that the broker takes? The answer to these questions must be known by the broker technical support, and if the answer is not explicit or late, this weakens its credibility…

There are many withdrawal and deposit methods provided by large brokers, which are considered to be low-commission methods with fast execution speed, such as:

Perfect Money 0.5% Fees (for verified accounts)

Skrill & Neteller (around 1% to 2.5%)

Binance (around 1%)

You will find most of the well-known brokerage companies accept these methods for withdrawal and deposit, and of course, these banks are reliable, so you can use them without any need to worry.

Please note (most brokers do not cost Fees in Withdrawal)

4 – Technical support

Try to open the broker website and contact the technical support and ask them about anything you want or inquire about. You may ask them about licenses or the history of the company … etc. and measure the speed of the response from the technical support and the extent to which it understands your question: Does technical support have sufficient experience and interest in solving customer problems or not? and do they answer the question clearly, or do they distract you to hide something?

There are many brokers that may manipulate prices and try to hide this from customers by making false excuses, the aim of which is to mislead and defraud customers, I do not mean slippage, as it exists in all companies, because there are many traders who lose because of slippage, but this is a very normal thing.

5 – The company’s interest in customers

Many factors can reveal the company’s interest in its traders, including

Contests: Like contests on the demo forex accounts & Real forex accounts, and contests for the partners (IB)

Prizes: Like gifts & Cash prizes when you achieve a number of lots

Bonuses: Such as a deposit bonus or a no deposit bonus.

Free educational materials

Cashback or Rebates

Referral Programs

The broker doesn’t need to have these features. It may provide one or two services, but the broker is good in this case. If these services are suitable for you, then there is no problem in joining this broker.

6 – Spread of each Forex account

Each broker provides spreads according to their wishes, but the broker that Offers lower spreads is competing with others for the sake of traders’ satisfaction, I strongly advise you to join this type of broker because most likely it will be an STP broker and this type of brokers offers the lowest spread To traders

The lower the spread or commission of the broker, the more it will be in your interest because in this way it will take less money from you and this will help you manage your trade properly.

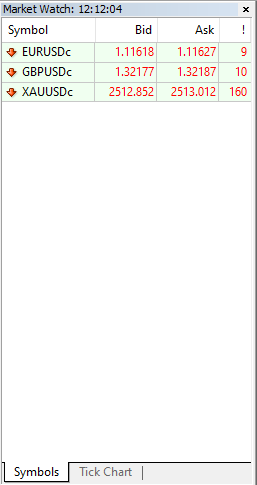

Mostly you will find that the spread on the EUR/USD is one pip or less, and this is in regular forex accounts, and you will find it less than that in ECN forex accounts, and there are many companies that offer ECN forex accounts.

There are forex accounts with a fixed spread, but you will find that the spread is slightly higher in these accounts because the fixed spread protects you from market fluctuations at the time of news. In this case, it is natural for the broker to raise the spread to compensate for the profits that he would have made from these fluctuations.

Which type of Forex accounts are better?

The broker offers many types of forex accounts to suit all traders. For example, there are traders who do not like high spreads but do not trade during news time or midnight. In that case, the standard or ECN account is suitable for them because they will get the lowest possible spread.

There are traders who prefer to trade during news time to benefit from the rapid movements that occur at such a time, but they cannot bear the cost of the high spread at this time. The spread sometimes reaches 12 pips!, which is very much. Therefore, it is appropriate for them to get a Forex account with a fixed spread. In this way, they will be able to calculate the risk well and set the stop loss with the amount they want to lose only, and not more than that.

7 – Educational material

Whenever the company supports traders, this indicates the good intentions of the brokerage company and the extent of its interest in the benefit of clients, not just profit, and educational materials such as

Webinars

Most brokers hold a webinar for their clients, which is an online lesson via Zoom, and the lecturer explains a trading strategy or a new indicator added by the broker, or it is a meeting between traders and account managers. These webinars are very important for developing traders and keeping them informed of everything new.

Seminars

It is like a webinar but on the ground and this is considered a good opportunity for you to get to know the company’s employees face to face and talk to them about anything you want in trading, such as inquiring about the company’s offers or requesting help in finding out the reason for losing your trades…etc.

Educational books

Not all brokers have their own books. You may find that the broker has PDF files explaining a strategy, indicator, or expert advisor.

Indicators and experts

There are many brokers who have developers working on creating new indicators and experts for their clients to use, and they may offer these products at low prices, or they make a trading contest to get that product, or even offer them for free in one of their webinars.

And Also, your account manager helps you when starting trading And guides you on your way in Forex.

8 – Leverage

This part is not necessary, because the large leverage is harmful to the trader and the most appropriate leverage is 1: 500, so if you see a broker that offers less leverage, this is not an indication of the bad of the broker (this is not a criterion for the company’s reputation), but the leverage is important in your trades so choose the broker that provides leverage to your liking.

9 – MT4 & MT5

Web trading may not suit many people, especially since there are advanced methods of predicting price movement using the trading platform which is MT4, or another more advanced platform such as MT5. If the broker provides these platforms, it will make your trades easier.

2 – Price manipulation

Many market makers manipulate prices and often exaggerate price slippage and change the shape of the candles on the platform. Such brokers I do not advise you to join with these types of brokers, but this does not indicate that all the market maker brokers are bad, but we explain the extent of the powers of the broker from this type

After you choose the broker you want according to what we have mentioned, open a demo forex account first and download the trading platform to test the platform and your strategy, of course, taking into account reading the Risk warning before Entering any trade or making a deposit.

3 – Forex Account verification

Every Broker asks you to verify your Forex account to verify the personal identity of the account owner and the place of residence also, so the company asks you for a set of documents for verification such as (an identity card – passport – driver’s license … etc.) and proof of your residence such as (bank statement – electricity bill – Water bill – mobile phone line contract – or any contract sealed by the government agency or private sector documented with the government)

After you test the strategy and platform and reassure your heart, open a real forex account and make a deposit with the appropriate amount for you to start trading (a minimum of $1000 is recommended for trading)

Conclusion

Steps to open a Forex account are not difficult, but choosing the right broker before opening the Forex account is the most important thing because the Broker is the one that will stay with you and support you always, as it is your partner in trading and if you face any problem of your Forex account he will help you, so choose it very carefully and look at clients’ Reviews Are they satisfied with this company or not and before starting to trade Learn first to make profits and not to blame the broker you work with for your loss, and be careful to choose STP broker because it is better than the market maker