6 Factors that can affect the psychology of traders

The psychology of traders is very important in making decisions. If the trader’s psychological state is bad, he may make wrong and confused decisions. On the contrary, if the psychology of a trader is good, he will make logical decisions based on knowledge and logic. There are many factors that may affect you negatively or positively in Forex.

1 – Emotional Factors can affect the psychology of traders

Many emotional factors may affect your trading psychology and make you make hasty and illogical decisions, and these decisions may lead to huge losses.

Fear

If you are a beginner in Forex trading, you may not realize that there is fear that may control you during your trading. Fear is a great enemy of the trader, as it prevents him from analyzing logically and making decisions based on the strategy followed. You may make decisions that you may be surprised that you made such rash decisions.

<<< Reasons Why Traders Fail when Trading Forex 2025 >>>

Greed

Greed may control you after several profitable trades and you think that you will never lose because you understand the nature of the market or that you are the one controlling the market. In fact, when you reach this point, you will be shocked by the huge loss that may happen to you because at that time you will not adhere to the rules that you had previously set to prevent you from losing.

You will not commit to risk management as you want to increase the amount of risk you are accustomed to because you want more money and when you do that the market makers have succeeded in luring you into losing.

Greed is the first enemy of the professional trader because he may forget that he was a losing trader one day, and reaching the stage of greed may make him remember the taste of loss again to adhere to the rules of the market and the strategy he follows.

Anxiety and Stress

It is very normal to feel anxious and nervous during your trading because we are human beings with feelings and emotions that are affected by the factors surrounding us. One of the most important factors that affect us is sitting in front of the chart for a long time or even for illogical reasons just because we want to follow the price movement.

If you have opened a trade on a pair, it is better to leave the chart completely and do something else that you like or do some exercises… etc. because sitting in front of the chart constantly will affect the psychology of traders negatively because it is natural that we do not want to lose the trade that we have opened and we want to make profits and this desire for profit may lead to illogical actions such as moving the stop loss/take profit from its place or even closing the trade without any reason

These actions may seem logical at first glance when making these decisions, but in reality, later you will discover that these actions are not logical at all, and you will be surprised later that the trade has gone to take profit after closing it, Stress and anxiety affect you negatively and there is nothing good in them, so you should avoid factors that may affect you negatively.

Personal Life and External Stressors

One of the factors that may make you nervous and feel anxious is external factors. Each of us has a family and people who love and care about, but when you mix your personal life with trading, this will bring many consequences. For example, if your relationship with your family or friends is not good and you try to remember this before entering a trade, you will make hasty decisions and will not take enough time before entering the trade.

Try to differentiate between your personal life and your trading life. For example, you can do some exercises that may help you relax before you start opening the chart so that you can analyze the market objectively and effectively.

Are you confident in your strategy?

Are you confident in the strategy you are working with? What I mean is whether you are confident that this strategy can work one day or not because you may have tested the strategy for a day or two and in this case, you will not be confident enough in the strategy because you have not known it well and have not tested it in different market conditions.

If this happens and you enter a trade, you will become nervous and anxious and you may abandon the strategy completely and seek the opinion of one of your friends or an analyst to tell you whether you should close the trade or leave it as it is, Taking the time to test your strategy and get used to it is very important to reduce stress, It also helps to improve the psychology of traders and make decisions based on knowledge and logic.

2 – Market Conditions

Adapting to market conditions helps improve the psychology of traders because in this case you are aware of what is happening in the market in terms of political and economic events and you are fully aware that the market is constantly changing, so anything can happen. In this case, you will accept the loss as you accept the profit, and this helps you to relax and not fear the loss. All these factors help you to make logical decisions based on the strategy you follow.

Follow the News that affects the market Here

Social media Influence

Social media is a double-edged sword. You can either use it to learn and follow the news and what is happening in the world, or You can use it as a way to distract yourself from making profits.

For example, you may follow the signals of a technical analyst and you will likely lose this trade because there are many analysts on social media who are not reliable. Even if the trade is good, the way you enter the trade may lead to its loss because you are not the person who analyzed the pair and you do not know what the factors for entering and exiting the trade are. You are not fully aware of what is happening to this pair.

It is also possible that you open a trade on a pair that you are trading for the first time and you do not know what factors are affecting this pair politically or technically, so you may open your trade and lose it and you do not know the reason for this loss.

I am not telling you that social media is bad, but not using it properly may make you lose a lot. For example, you can use it to share your analyses in the forums, and the members of the forums will help you share their opinions as well, and you will get a good view of the analysis that will help you make an appropriate decision, and through this sharing, it will help you develop yourself more and more.

Comparing yourself to others

When you check out the traders analysis you will find many of them winning and losing, so do not be affected by these analyses so as not to affect your psychology as a trader. Comparing yourself to others is a very bad thing because you do not know what this analyst did to reach a good level of understanding of the market. You may also reach this level one day, but all you need is patience and learning. Instead of comparing yourself to others, try to learn from their method of analysis. This will improve your performance over time.

Having a mentor

Having a mentor on your trading journey will greatly help to improve the psychology of traders. This mentor could be a friend or a Good analyst who has experience that you can rely on and you both analyze in the same way. In this way, you can learn from him and resort to him if you want advice.

3 – Fear of Missing Out (FOMO)

The fear of missing out is when you see a potential trade but the entry conditions may not be complete. But here comes the fear factor of missing out on this opportunity and rushing to open the trade and completely forgetting the factors of entering the trade, the most important of which is checking the news.

Making hasty decisions is certainly not beneficial at all, and the uncertainty that the market is full of opportunities will make you lose more and more. Patience is a very important factor for the success of any trader and to make the traders psychology good.

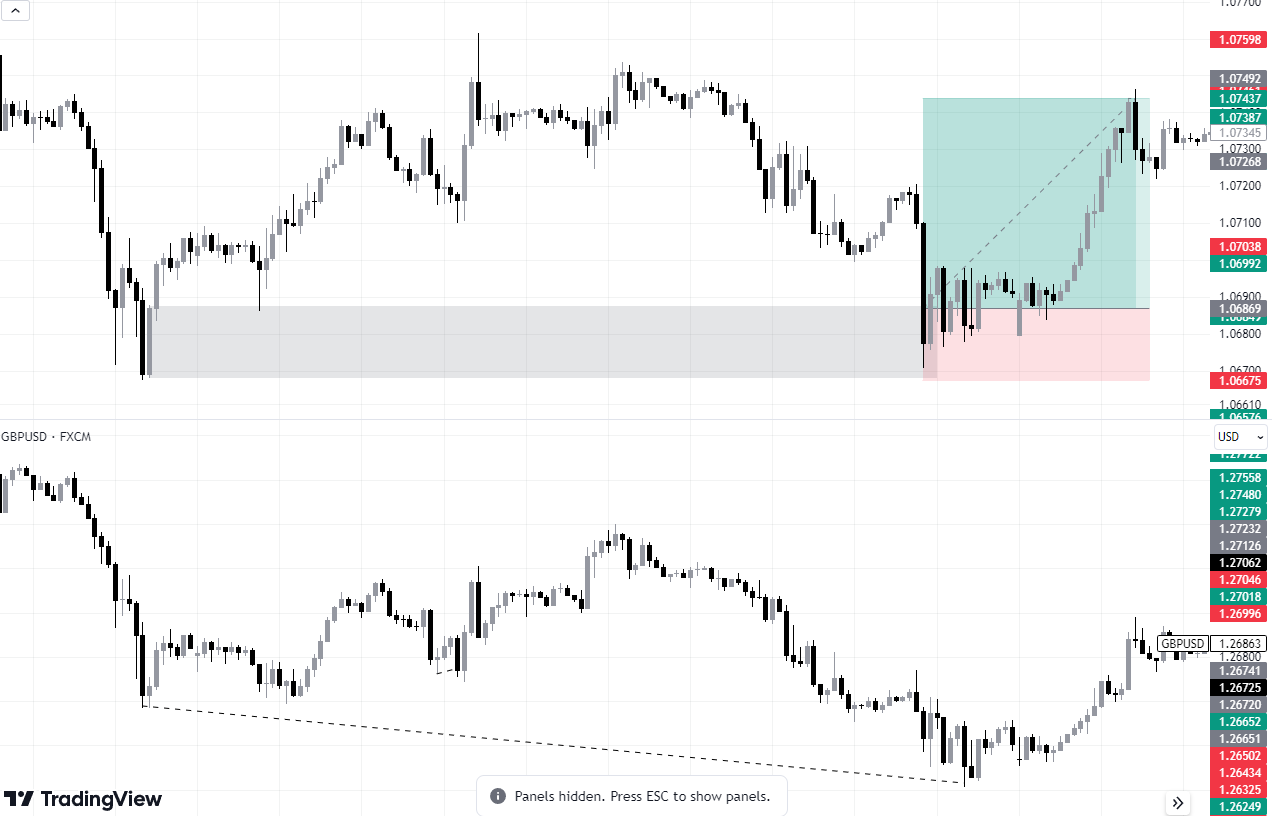

This example shows how FOMO controls traders and makes them make hasty decisions away from logical analysis.

There was a good supply level but the price had not reached it yet and the price bounced before reaching this area to make the FOMO traders believe that the price would not reach this area and would bounce from this peak, here is the bait for the FOMO traders

They rushed to enter the trades and opened sell orders before the price reached the Order Block from which it wanted to fall. When the price rose, there was no sign of a fall yet, and the price continued to rise until it made those who wanted to sell from this area lose as well because the appropriate sign that would make you sell from this area did not appear.

Then a sell signal appeared (Rejection Candle) after the market makers made the FOMO traders lose, And it Fell to very far levels, when that happens, of course, you will be overcome by a feeling of sadness and despair, So trading while you are afraid that you might miss a trade and not being patient may lead to big losses in the future.

FOMO vs Patience

The first enemy of FOMO traders is patience. If you want to get rid of this fear, you must be patient with everything related to Forex. That is, you must be patient with profit and loss and find the right opportunity to open a trade. You will not move the market with your hands. The market moves as it wants. This is an investment market. You must understand this well. Rushing will not bring you more profits in a short time. Quite the opposite.

Does your strategy encourage FOMO?

Your strategy may be working against you, not for you. It is possible that your strategy works on short time frames and encourages you to enter into frequent trades during the day, and then you are surprised that you have entered into reckless, ill-considered trades that are far from the strategy you are following, choose a strategy that suits you and does not constitute a burden on you so that you can be wiser in entering your trades.

Patience in losing & winning trades

Patience is certainly very important in Forex and patience pays off in the end, but using patience in the wrong way may make you lose suddenly.

What makes you patient? Is the plan you are following correct? So if you are patient about the decision to open a trade and you want to leave this trade until it reaches the take profit or stop loss, this is a very good decision, but in the event of sudden news in the market, should you be patient and not make any decision?

There is strong news happening in the market without being present in the economic calendar. If this news occurs, you must make a decision: either close the trade so that this news does not affect you and you will not lose your money. This is, in my opinion, a very good decision, or stay in the market hoping that the price will reach the take profit.

Both decisions are in your hands: either you take a decision that may protect your money from unnecessary loss, in which case you still have capital that you can trade with another day, or you take a risk and risk your money in a trade that has become incomprehensible economically, in which case the price may exceed the stop loss and you may lose more than you expected.

The market does not care about your loss or profit, as it moves based on the factors that make it move, such as supply, demand, liquidity, etc. The market does not know about your presence, and the price movement will not change if you enter a trade or not.

5 – Trading on multiple pairs

The trader can trade on any pair he wants, but choosing more than one pair at the beginning may greatly affect the psychology of traders.

There is also a method that you can follow if you want to trade more than one pair. For example, if you are trading the EUR/USD, this pair is similar to the GBP/USD. You can analyze both pairs and compare these two analyses with each other and look for the best opportunity to enter the trade on the pair that suits your analysis.

You can add the dollar index to your analysis, as the dollar index moves in the opposite direction of the EUR/USD and GBP/USD pairs. In this case, you will see if the dollar index gives you good signals to enter a trade and look for this opportunity in the EUR/USD or GBP/USD.

In this example, there was an SMT Signal or “smart money technique” and when the GBPUSD fell and broke the previous bottom, the EURUSD did not fall and failed to break the previous bottom. This is a signal that the EURUSD is strong and the price will likely rise from the demand zone.

Also, the same thing happened with the dollar index. When the index rose and broke the top, the EURUSD could not break the bottom. This remains a good signal to buy the EURUSD. The dollar index signal is a confirmation of entry if you want to be sure of your entry into the trade with more than one confirmation.

It is not necessary to combine pairs in this way, but I gave an example of how to work on more than one pair so that you can get a clearer vision of what is happening in the market and so that this serves your analysis and the decision that you will make in the end.